Monitor, Assess & Benchmark your Carbon Portfolio

PORTFOLIO ASSESSMENT & MONITORING

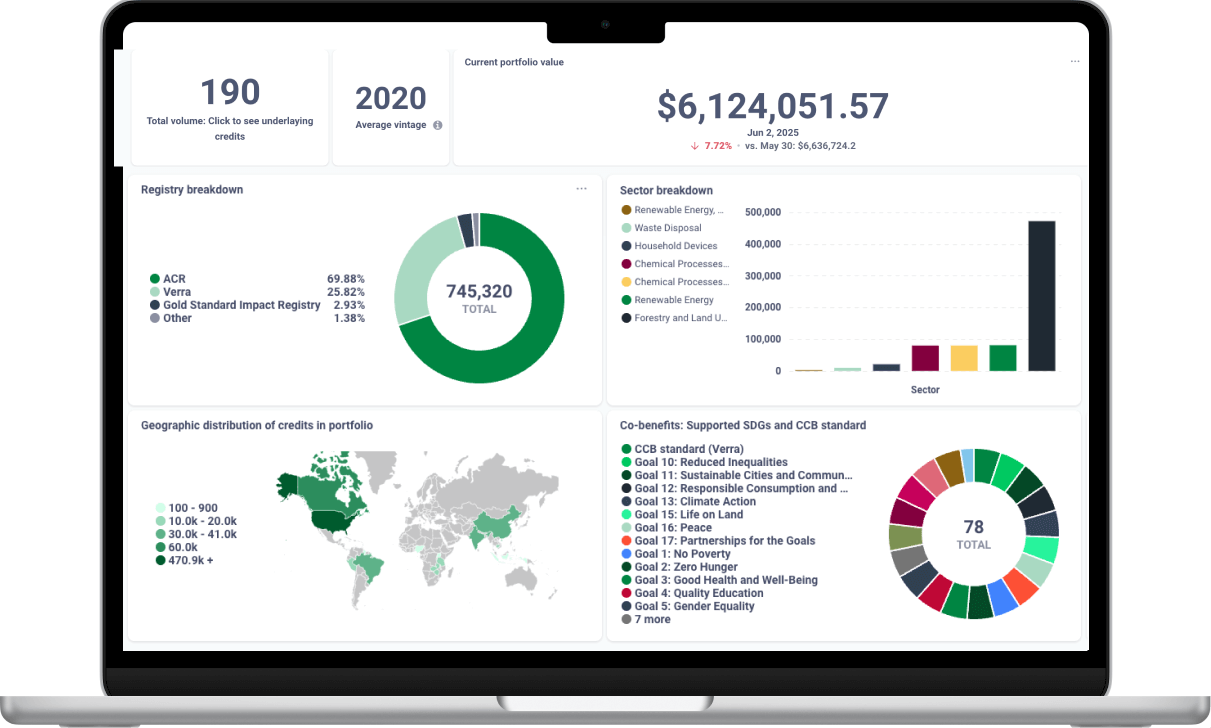

AlliedOffsets help businesses reduce risks and save time by identifying what factors are influencing the value of their portfolio. With this tool, businesses can monitor, assess and benchmark their carbon portfolios supply, demand and prices – all in one place. Whether you are looking for a one off assessment, or an interactive monitoring dashboard, we’ve got it covered.

Explore our political risk metrics, project updates and prices to monitor your portfolio’s performance over time, and compare the value changes and forecasted profit opportunities with other sectors and regions.

Manage risks, evaluate and benchmark portfolio performance over time

Live portfolio updates - all in one place

Get connected with sellers through live offers function

Live portfolio value & individual credit listings and performance tracking

Demand, pricing and retirement analysis of carbon portfolio

Explore risk and quality metrics including Article 6, compliance eligibility & ratings

Access bid and offer prices, confidence scores and liquidity assessments for credits in your portfolio

Live portfolio updates - all in one place

Get connected with sellers through live offers function

Live portfolio value & individual credit listings and performance tracking

Demand, pricing and retirement analysis of carbon portfolio

Explore risk and quality metrics including Article 6, compliance eligibility & ratings

Access bid and offer prices, confidence scores and liquidity assessments for credits in your portfolio

*Please note that this free version is only filtered for projects in ACR, Climate Action Reserve, Gold Standard Impact registry and Verra. To access the full version of the tool, please speak to our team.

How can you get an evaluation and monitor your portfolio?

Forecast Portfolio Value, Prices and Demand Drivers

FORECAST SUPPLY

Forecast supply using low, medium, and high supply scenarios to indicate potential market saturation

FORECAST DEMAND

Forecast the demand for the top sectors and regions currently purchasing your portfolio make up

FORECAST PROFITS

Forecast potential profits of your portfolio using low, medium, and high demand scenarios

BENCHMARK PERFORMANCE

Benchmark portfolio forecasts against sector/ region, and custom price and demand forecasting scenarios