The home of carbon market data: where innovation drives intelligence

Transparency and market intelligence for the voluntary carbon market. Tracking every project, buyer, and trend across global registries.

Voluntary Carbon Market 2025 Review

AlliedOffsets’ latest report provides a data-driven overview of how the voluntary carbon market evolved in 2025, highlighting where growth has returned, where risks remain, and how buyer behaviour is changing.

Key findings

-

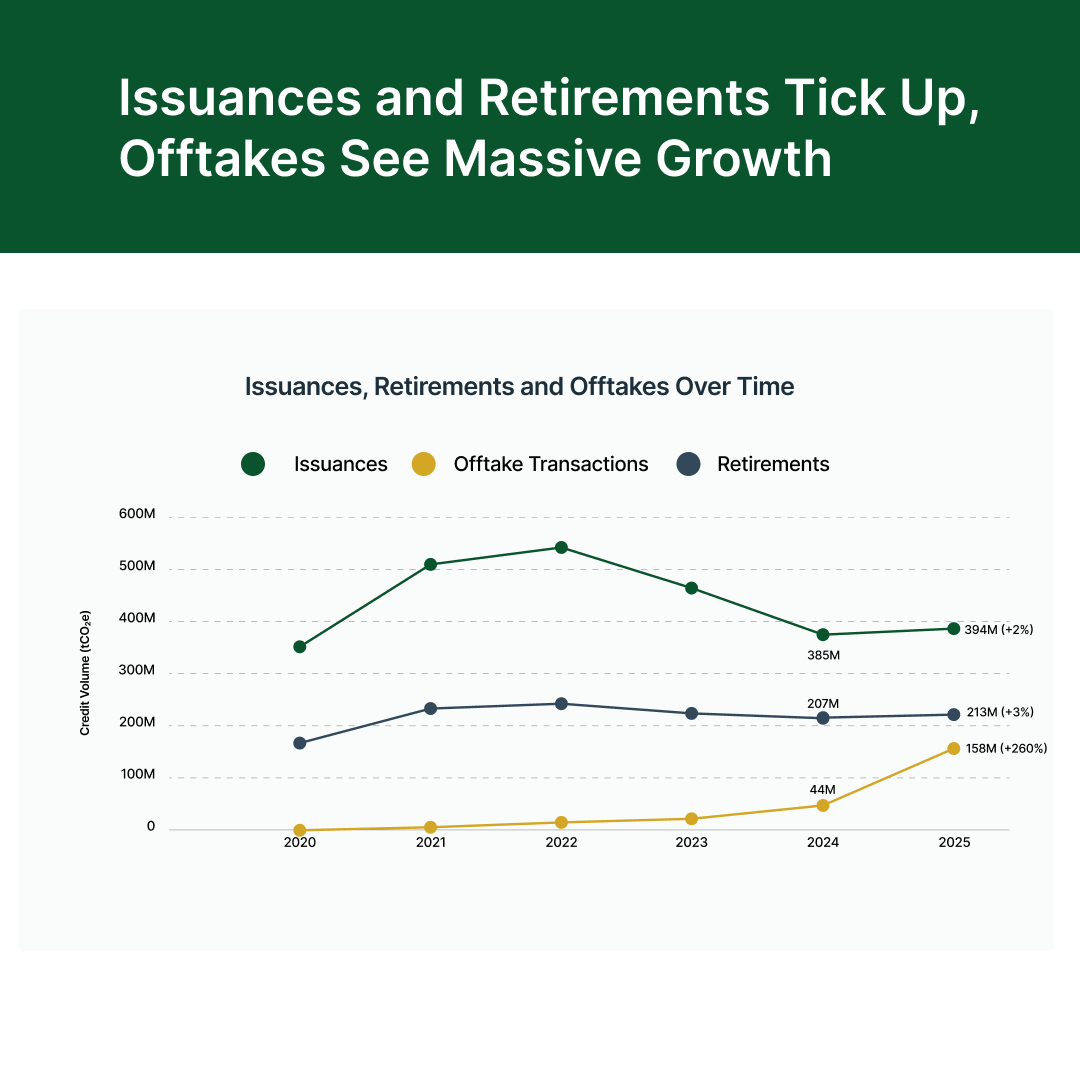

The voluntary carbon market returned to growth in 2025, with rising retirements, record offtakes, and total market value surpassing $10 billion.

-

Demand remained concentrated among fewer buyers, geographies, and project types, despite higher overall volumes.

-

Carbon removals gained market share, with both technical and nature-based removals leading offtake and retirement activity.

-

CDR issuance and project listings reached record levels, driven primarily by biomass-based removals such as biochar and BECCS.

-

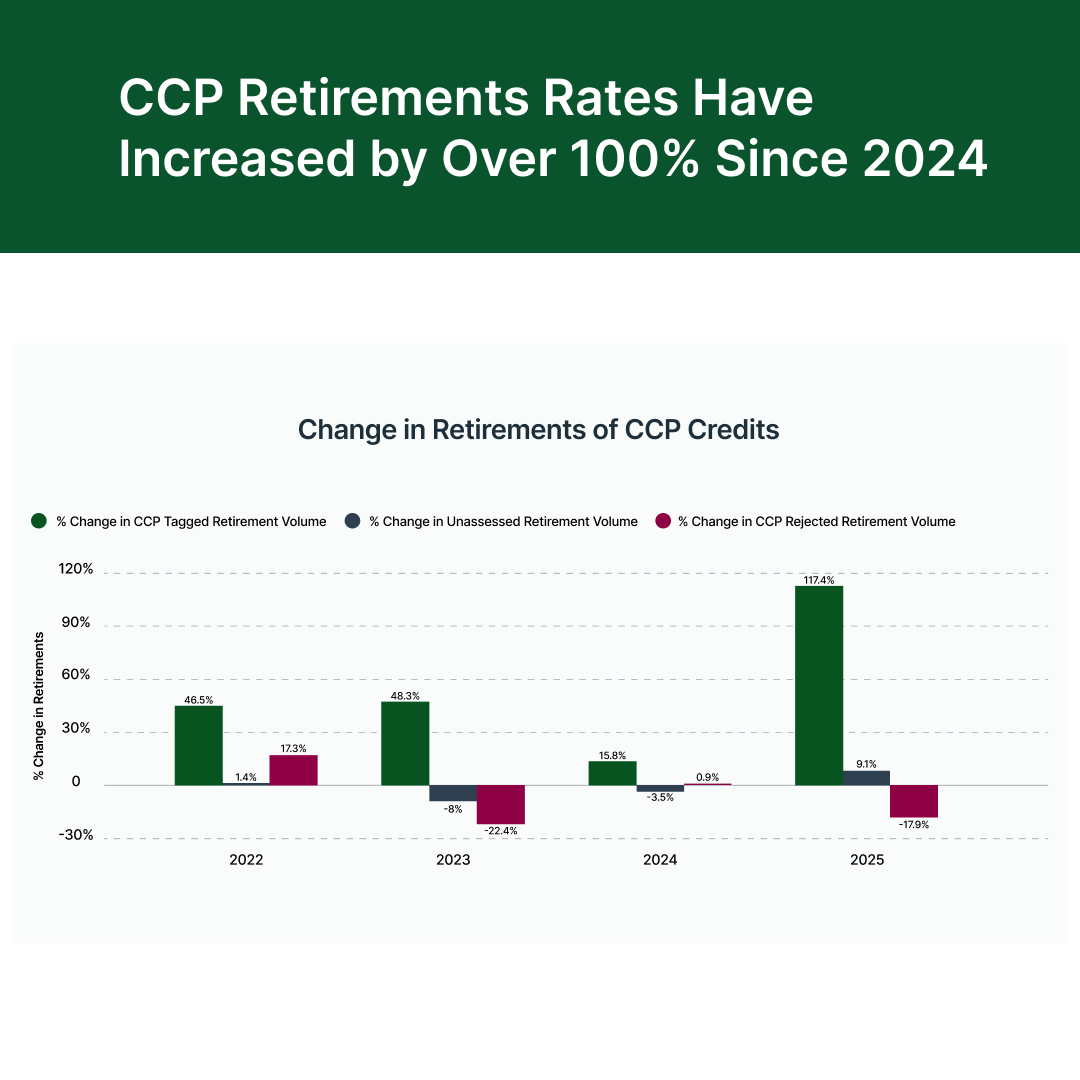

Policy and integrity signals strengthened, with CCP-labelled retirements up by 100% and around 50% of schemes accepting or considering offsets.

Our Data

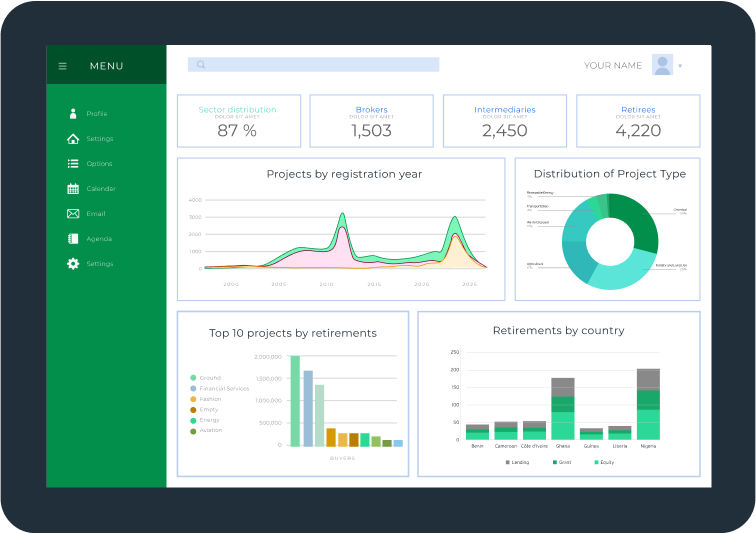

AlliedOffsets provides advanced analytics, forecasting, and benchmarking tools built on the most comprehensive carbon market dataset.

Our platform covers current market activity and forecasts future trends in the voluntary carbon market.

This data is updated on a regular basis, allowing investors, researchers, consultants, brokers, marketplaces, and others to conduct bespoke, in-depth analysis on the carbon markets. Explore some of our data from our dashboard below!

37030

projects

1106

CDR companies

28636

corporate buyer profiles

Our Solutions

We offer a number of different solutions to fit your unique carbon data needs. This includes a data dashboard for voluntary carbon market activity, an API for data scientists and developers, AI tools for processing project documents, bespoke dashboards, reporting and consulting work.

Who We Work With

Project Developers

Track latest prices for your credits, find buyers and brokers, and conduct competitor analysis.

Consultants

Identify market trends in purchases, pricing, and policy developments.

Brokers & Traders

Find buyers and identify eligible compliance schemes for credits in your portfolio.

Corporates

Uncover credits that match your needs and keep up with latest policy developments.

Financial Institutions

Get the data you need to find an edge and make sound investment and trading decisions.

Academics & Researchers

Conduct in-depth research on pricing trends and carbon market impact on a global scale.