Align Carbon Investment Decisions with Wider ESG Strategy

Data Use Cases

De-Risk Investment

Our data empowers corporations to make informed investment decisions by providing the latest market intelligence. Users can easily compare projects and evaluate how different quality metrics and ratings align or differ, helping them identify high-quality projects based on specific criteria.

AlliedOffsets data allows companies to assess the quality of carbon offsetting projects, safeguarding their investments and protecting their corporate reputation. Users can analyze projects based on CCP, CORSIA, and tax scheme eligibility, ensuring their investments are future-proof against upcoming industry standards.

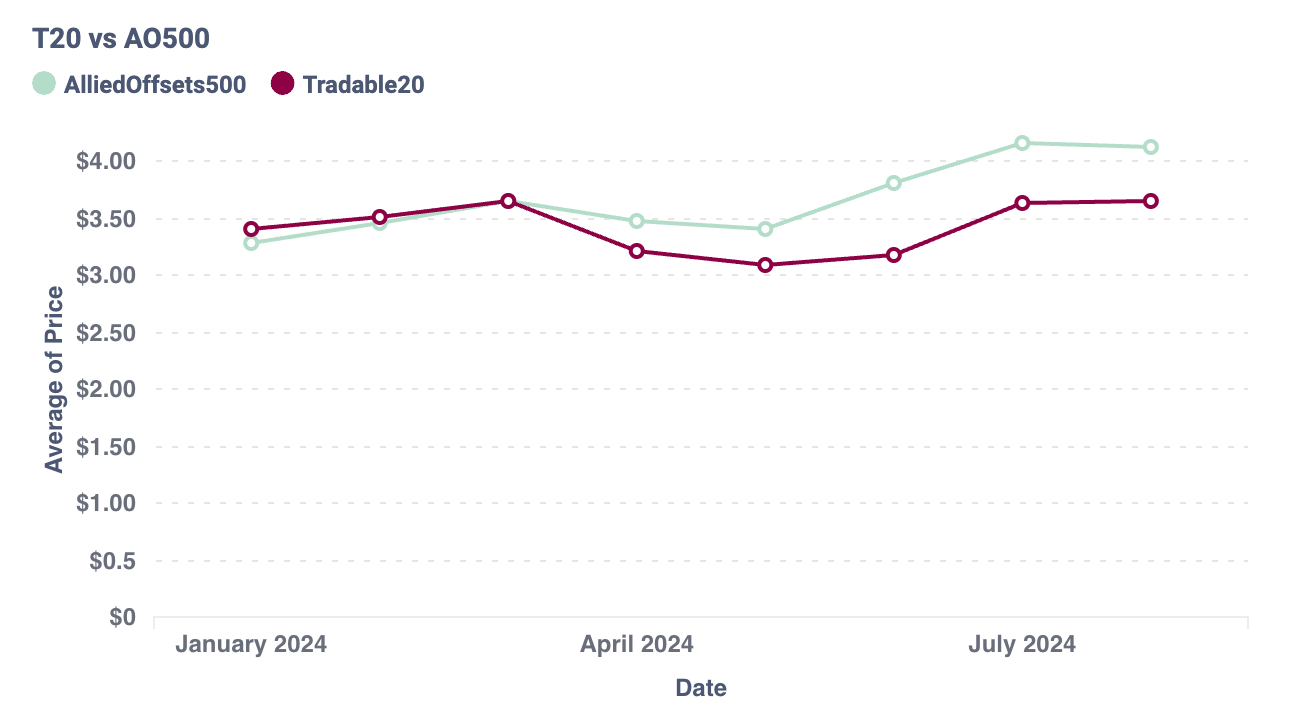

Identify Carbon Pricing Trends

AlliedOffsets provides comprehensive carbon market pricing products, including our price indices such as the Tradable20 and AO500. We analyze over 26,000 annual transactions to accurately predict price points for more than 30,000 VCM projects, achieving an accuracy rate of 93% to 97%. Our platform enables users to monitor pricing trends tailored to their portfolios, including regional differentials, helping them optimize financial strategies and make informed decisions on when to buy and sell credits.

Find out moreAlign Investment with Wider ESG Strategies

Corporations use AlliedOffsets data to identify investment opportunities and projects that align with their broader ESG strategies and sustainability targets. By leveraging our comprehensive market intelligence, companies can evaluate potential investments to ensure they meet specific environmental, social, and governance criteria. This enables businesses to not only achieve their sustainability goals but also to drive long-term value through responsible and strategic decision-making.