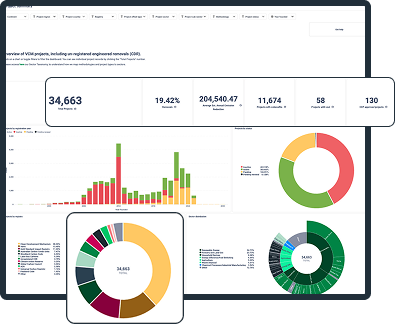

Tailor Your VCM Dashboard Experience

Explore our Modular Offerings

Our data is used by leading sustainability and carbon consultants, financial institutions, offsetting corporations, project developers, buyers, academics and others. Due to our diverse range of customers and their data needs, we offer a number of different products and modules to fit our customers wide range of unique carbon data and analytics needs. Thanks to our modular offerings, we can make sure you only pay for the data you need. We also work with our customers and offer to build custom dashboards and insights to suit their needs.

Get Access to the Data You Need!

Modular Offerings:

Carbon Buyers & Business Development

We have analyzed the activity of over 15,000 buyers in the Voluntary Carbon Market (VCM), achieving an impressive 84% match rate for all known retirements to corporates. Our versatile buyer module caters to a variety of use cases, tailored to meet your specific needs.

One popular use case is that users can filter buyers by the price they are willing to pay, the sector they work in, and their sustainability commitments to identify a target list of buyers.

What data is included in the module:

- All time corporate retirement data from 30+ registries and 16,000+ buyers

- Detailed company overview and information including, buyer sectors, HQ, emissions and VCM activity

- Buyer contact information for over 1,000 buyers

- SBTI / Net Zero commitments

- Decarbonization trajectories to 2050

- Sector specific demand modelling

Traders Tool

The AlliedOffsets Traders module integrates market-leading pricing data with market activity, retirement trends, and our quality assessment tool. It provides carbon traders with real-time access to accurate market intelligence, price movements, and live offer prices.

Explore pricing based on compliance eligibility, co-benefits, and CCP approval, and explore the relationship between integrity metrics and project prices. This module also includes access to our market leading corporate buyer lead generation tool.

What data and tools are included in the module:

- Utilize our Quality Normalization tool to compare projects quality scores, and identify high quality projects for a lower price

- Deep dive into specific markets with this tool that analyze how project characteristics and integrity metrics influence price trends.

- Detailed company overview and information including, buyer sectors, HQ, emissions and VCM retirement activity

- SBTI / Net Zero commitments

- Decarbonization trajectories to 2050

Sector specific demand modelling

Carbon Policy

AlliedOffstes Policy Module provides an overview of the latest policy news and unique tools for teams working in the voluntary carbon market.

Our policy module allows users to assess country political risk scores to manage investments, keep up to date with the latest Article 6 developments and track VCM credits retired or cancelled for compliance purposes. Users can also track supply, demand and price of CORSIA eligible credits.

What data is included in the module:

- We track compliance schemes that allow voluntary carbon credits, eligible credits for each scheme, and credit retirements for different compliance uses and countries.

- Country Political Risk Metrics: Political Stability such as government stability, international conflicts, political violence and terrorism, social unrest, military coups etc.

- We track countries NDC targets under the Paris Agreement, active national registries and carbon exchanges, Article 6 implementation and carbon tax rates and carbon offset mechanisms.

- Track present supply, forecasted supply, demand as well as price and purchase activity of CORSIA Eligible Emissions Units (EEUs).

VCM Prices & Markets

The AlliedOffsets Prices & Markets Module provides real-time market intelligence, carbon credit prices, and trend analyses to support informed decision-making.

Users can conduct project and sector historical pricing analysis, analyze future issuance from active and pending projects and compare project / sector prices over time.

Users can also explore relationship between different quality metrics and project prices, and compare offtakes and prices paid for pre-purchase agreements vs. traditional VCM retirements.

What data is included in the module:

- Granular Carbon Pricing Data & Movements: Compare project prices and historical prices and evaluate project liquidity data and fluctuations.

- Prices and Markets Explorer: Deep dive into specific markets with this tool that analyze how project characteristics and integrity metrics influence price trends.

- Project Quality & Pricing Tools: Utilize our Quality Normalization tool to compare projects quality scores, and identify high quality projects for a lower price.

- Weekly VCM update: Explore a weekly snapshot of market activity including issuances, retirements and prices, and analyze week-on-week averages of project prices by vintage or other characteristics.

Carbon Dioxide Removal (CDR)

AlliedOffsets has developed a database of over 950 carbon dioxide removal (CDR) companies around the world, the largest database of such projects in the world. CDR can be particularly important in helping to decarbonize hard to abate sectors.

Users can conduct research on CDR developers, conduct competitor analysis & benchmarking and identify CDR buyer activity & patterns.

Furthermore with this module users can explore price & capacity projections for different methodologies, map facilities by methodology and analyze CDR offtake agreements.

What data is included in the module:

- Market Insights: CDR Market Trends, Project Prices & Projections, Capacity & Projections and CDR Policy.

- Buyer & Marketplace: CDR Buyers & Retirement Data, buyer sonsortium, CDR marketplace and CDR offtake agreements.

- CDR Innovation: Investors & accelerators, CDR technology patents and CDR university ranking.

- Project & Developers: CDR developer details and project details including location, facilities and methodology mapping.

Projects and Project Due Diligence

The Projects & Due Diligence Module provides teams with comprehensive insights and tools to streamline project evaluation and risk assessment. From geospatial and biodiversity data to quality metrics and multi-agency ratings, this module offers support for informed decision-making.

With this module, users can compare countries regulation readiness for carbon market developments and identify risks by comparing project forecasting issuances vs actual issuances and identify projects with low reversal risks due to fires or floods.

What data is included in the module:

- Project Details and Insights: Explore project details such as: location, top known buyers, issuances and prices over time. Geospatial and biodiversity insights.

- Project Integrity Metrics: Review project quality metrics including: CCP, CORSIA, compliance eligibility, co-benefits (like the SDGs) and LoA scores for over 35,000 projects.

- Developer Details: Developer details includes location, issuances, retirements, top buyers, average prices, and overall market share for issuances vs retirements.

- Project Ratings: Project ratings include: Sylvera, BeZero, CCQI, Renoster, Sustaincraft and Ecoptima. Compare ratings for the same projects.