Pricing & Activity

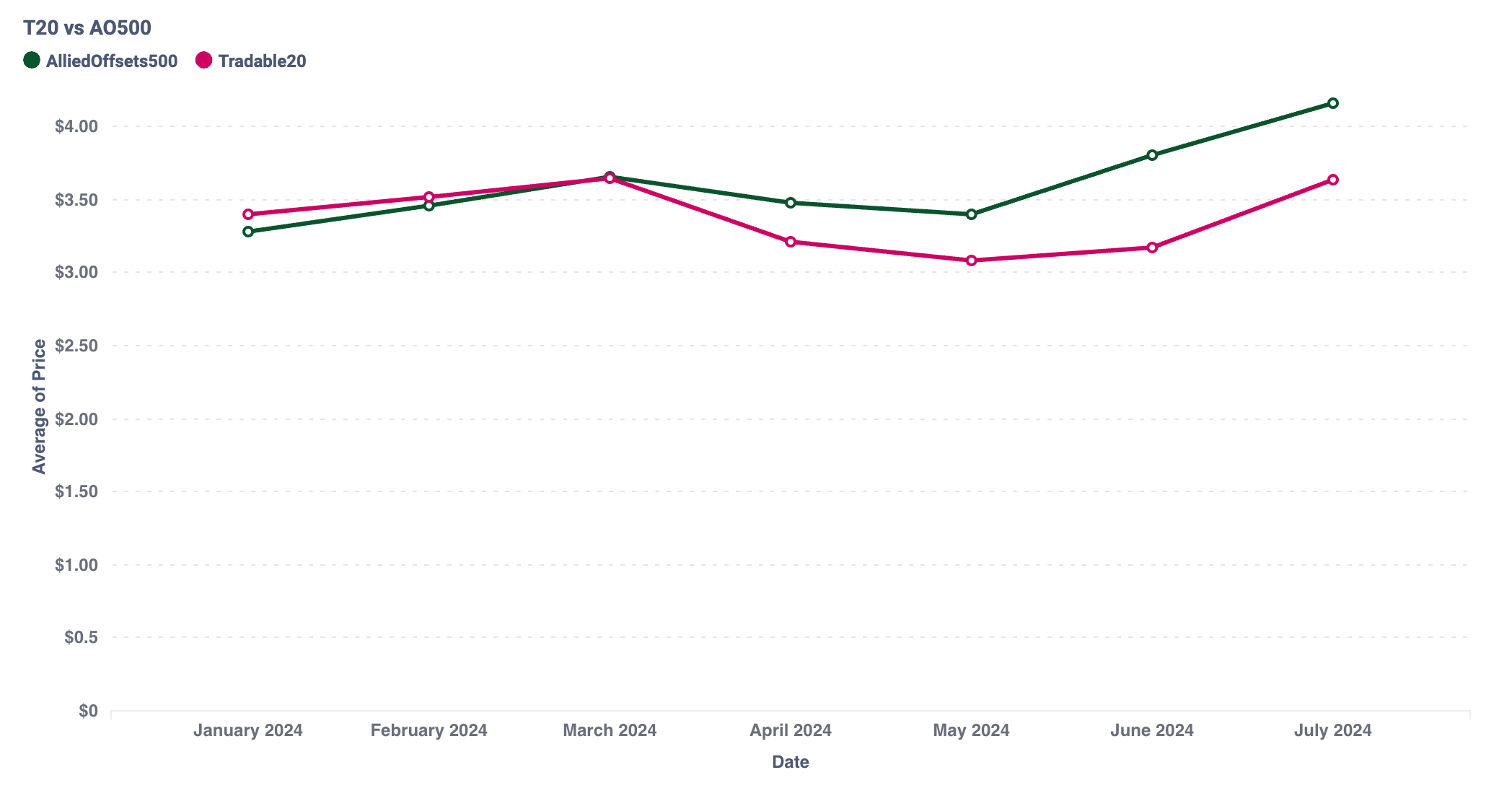

AlliedOffsets has developed extensive carbon market pricing products including price indices such as the Tradable20 and the AO500. Below, we are also showing a snapshot of some of the pricing data we track.

Sign up to our weekly pricing newsletter

Pricing, Retirements & Latest Transactions

The AO Price is a weighted average of the price estimates for the top 500 projects whose credits are being retired in the market – an imperfect but necessary way to put a singular number on the price of offsets. The indices below that showcase the weighted average price of credits that match a specific criteria (e.g., projects based in Asia).

Trusted by our Clients

What does our Clients have to say about AlliedOffsets?

“AlliedOffsets’ API integration has been essential for illuminem. It provides the comprehensive, real-time carbon buyer data we need to enhance our sustainability insights platform. This partnership has significantly helped us to build valuable new offerings for our clients.”

Markos Chrysikopoulos

Co-Founder and Chief Product Officer at illuminem

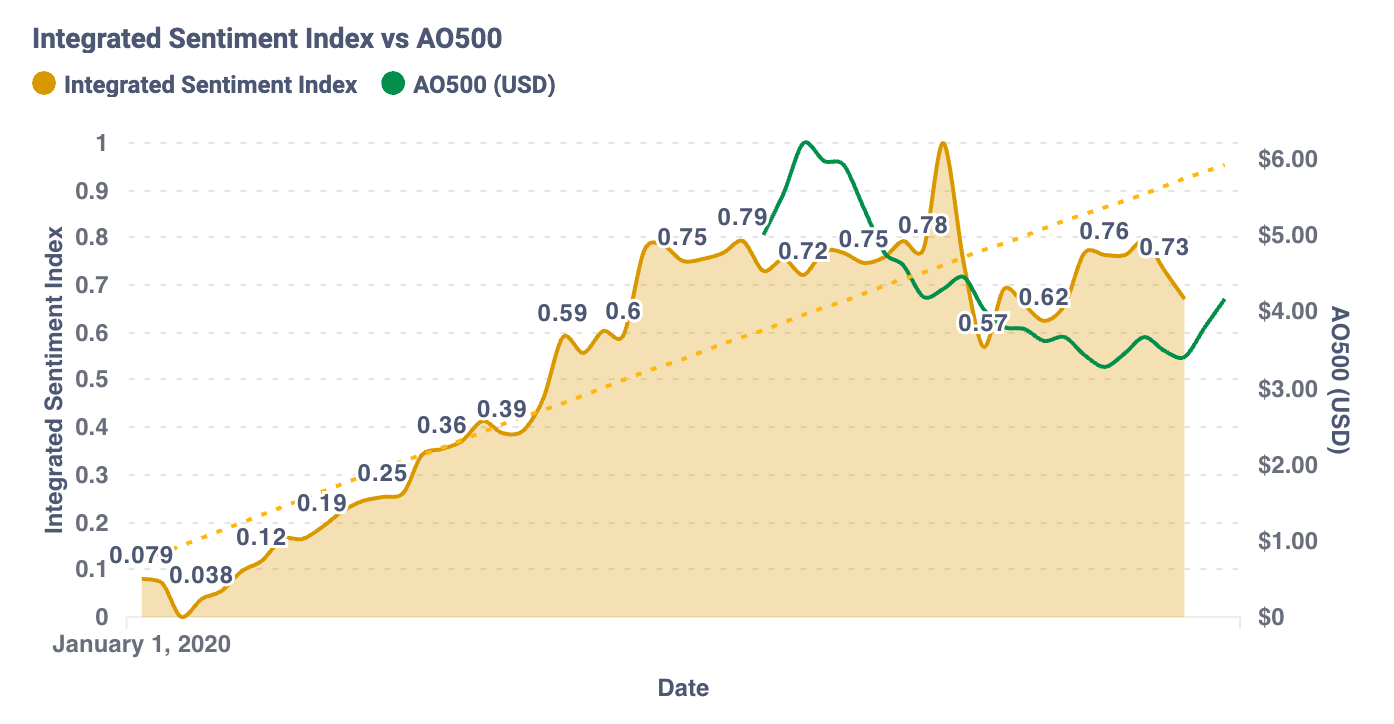

Carbon Forecasting

The Voluntary Carbon Market is currently valued at $1.3 billion but AlliedOffsets projects this to exceed $161 billion by 2050, driven by rising demand, stricter quality standards, and growing net zero commitments.

Despite today’s market being fragmented, oversupplied with low-integrity credits, and constrained by low prices, a shift toward high-integrity carbon markets is underway. Our customized, data-led approach empowers companies to make informed, future-proof investment decisions during this transition.

Learn more, speak to our team